Expert Advice from Madhur Kukreja, Certified Financial Planner

In today’s ever-changing financial landscape, achieving financial stability and growth can be a challenging endeavor. However, one essential strategy that can significantly impact your financial success is diversification. At Happy FinServ, a trusted name in financial planning based in Rohini, Delhi, with over 30 years of experience, we firmly believe in the power of diversification and its importance in achieving your financial goals. In this article, we’ll explore the significance of diversification, provide real-life examples, and introduce you to our expert, Madhur Kukreja, who has over three decades of experience in the field.

What is Diversification?

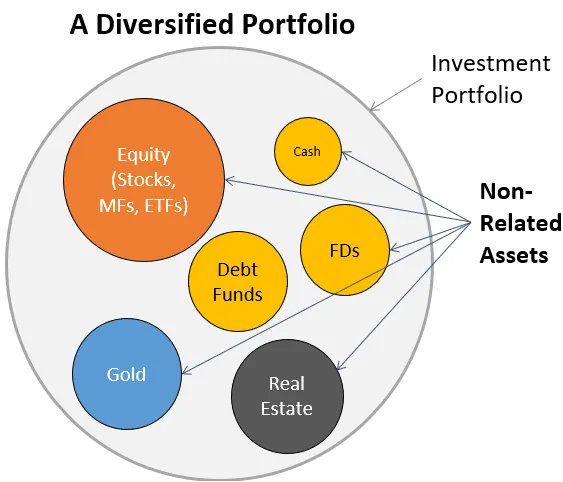

Diversification is a fundamental principle in the world of financial planning. It involves spreading your investments across various asset classes and securities to reduce risk and potentially enhance returns. By not putting all your financial eggs in one basket, you can mitigate the impact of market volatility on your overall portfolio.

Why Diversify?

Diversification is crucial for several reasons:

- Risk Mitigation: One of the primary benefits of diversification is risk reduction. When you diversify your investments, you’re less exposed to the fluctuations of a single asset or market segment. For instance, if you only invest in one stock and it performs poorly, you may suffer significant losses. However, by diversifying into different stocks, bonds, real estate, and other assets, a poor-performing investment is less likely to have a catastrophic impact on your portfolio.

- Enhanced Returns: While diversification is primarily about risk management, it can also lead to potentially higher returns. Different assets perform well at different times. By having a mix of assets in your portfolio, you increase the likelihood of having some investments that perform strongly even when others are underperforming.

- Peace of Mind: Diversification provides peace of mind, knowing that your financial future isn’t solely dependent on the fate of a single investment. This can reduce stress and help you stay committed to your long-term financial goals.

Real-Life Example: The Benefits of Diversification

Consider the story of Mr. and Mrs. Sharma, clients of Happy FinServ. Initially, their portfolio was heavily weighted towards stocks in a single industry. When that industry faced a downturn, their investments suffered significant losses. However, with the guidance of our expert, Madhur Kukreja, they diversified their portfolio by adding bonds, real estate, and international stocks. As a result, they not only reduced their risk but also achieved a more stable and profitable portfolio.

Meet Madhur Kukreja – Your Diversification Expert

Madhur Kukreja, a Certified Financial Planner at Happy FinServ, brings over 30 years of invaluable experience to the table. His expertise lies in crafting diversified portfolios that align with your financial goals and risk tolerance. With a track record of helping clients navigate various market conditions, Madhur is your go-to expert for financial planning.

How We Can Help

At Happy FinServ, we are dedicated to helping you secure your financial future through diversification and other proven strategies. Whether you’re just starting your financial journey or looking to optimize your existing portfolio, we’re here to assist you. Feel free to call us at +918719820130 or visit our office using the Google Maps location provided. Your financial goals are our priority, and together, we can make them a reality.

In conclusion, diversification is a powerful tool in financial planning that can lead to reduced risk and potentially increased returns. Happy FinServ, with its decades of experience and expert team, is your partner in achieving your financial objectives. Don’t hesitate to reach out to us for personalized guidance and a brighter financial future.